Renters Insurance in and around West Plains

Welcome, home & apartment renters of West Plains!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

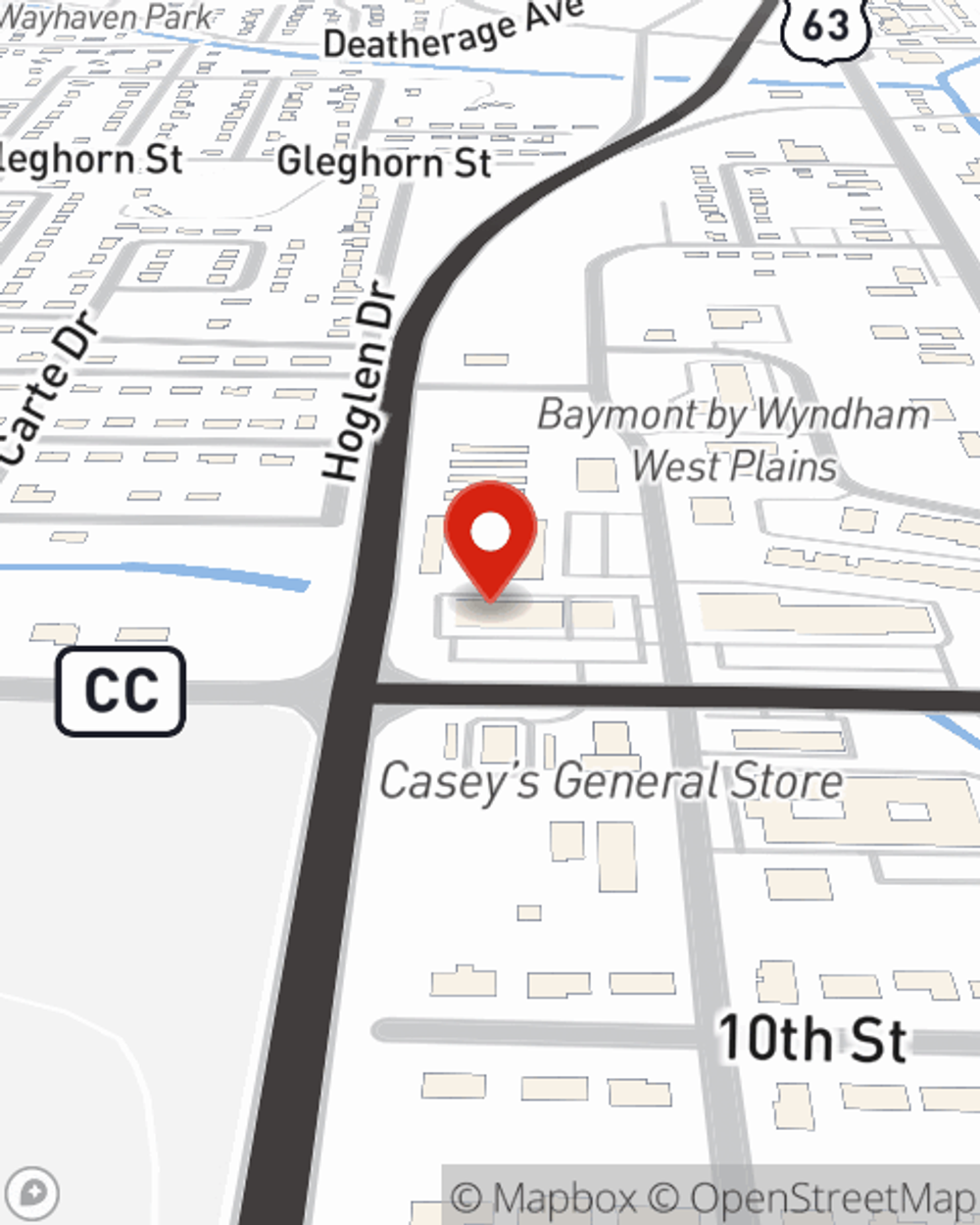

You have plenty of options when it comes to choosing a renters insurance provider in West Plains. Sorting through deductibles and coverage options to pick the right one is a lot to deal with. But if you want great priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy incredible value and no-nonsense service by working with State Farm Agent Justin Shelby. That’s because Justin Shelby can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including sound equipment, cameras, mementos, furniture, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Justin Shelby can be there to help whenever mishaps occur, to get you back in your routine. State Farm provides you with insurance protection and is here to help!

Welcome, home & apartment renters of West Plains!

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

Renters insurance may seem like last on your list of priorities, and you're wondering if you really need it. But imagine what would happen if you had to replace all the valuables in your rented home. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your stuff.

If you're looking for a reliable provider that can help you protect your belongings and save, get in touch with State Farm agent Justin Shelby today.

Have More Questions About Renters Insurance?

Call Justin at (417) 256-3434 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Justin Shelby

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.